Yes, high volatility means more investment opportunities,only if one can find the "holy grail" for the market. Unlike those traditional trading models built on price momentum (technical models) or rate differentials (the carry trade model), I have recently developed a new framework for currency trading which employs a nubmer of factors including Fundamental factor, Irrational factor, and Technical factor. The FIT model (the abbreviation for the first letter of all the three factor categories) is built as a fusion of fundamental analysis and financial engineering, which may benefit from pronounced up or down trends in the global FX markets. The currencies included in the strategy are Euros, British Pounds, Canadian Dollars, Swiss Francs, Australian Dollars, and Japanese Yen.

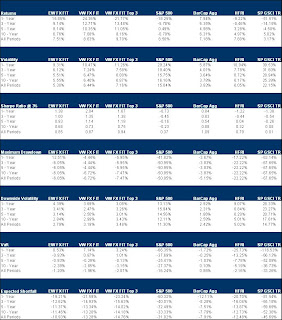

The following tables show the historical backtesting results for the strategy. Over the last 20 year, only 2 years realized small negative returns (-0.36% for 1994 and -0.19% for 2007)…