I recently wrote an artitle on multi-asset investing for Professional Wealth Management magazine which is part of the Financial Times Group.

Basically, the perfect storm of the financial crisis nullified the supposed diversification benefits of multi-asset class strategies, but it is argued that for a range of innovative featues, they can provide investors with a more efficient and effective diversification strategy.

For more details, please refer to the following web link.

http://www.pwmnet.com/news/get_file.php3/id/297/file/p23+pwm.pdf

Thursday 15 October 2009

Wednesday 14 October 2009

"Honey, I Shrunk the Portfolio Concentration Risk!"

The 2008 crisis was unique in terms of its speed, the jump in correlations and the fall in liquidity. Multiple asset-class returns have been headed in the same direction: down!

The dramatic downturn in 2008 severely shook the confidence of investors in the ability of traditional risk management practices to mitigate their downside exposure. Traditional portfolio optimization with asset weights constraints might not generate truly risk-diversified portfolio. The resulting optimal portfolios tend to be overly concentrated in a very limited subset of the full assets or securities spectrum. For example, traditional 60/40 (i.e., S&P 500 and Lehman Aggregate) or so-called balanced portfolios do not offer investors true diversification because the 60% stock allocation (S&P 500) actually accounts for almost 95% of the portfolio risk. In a sense, 60/40 portfolios put almost all the “eggs” in one basket. When (not if) the stock market has a severe downturn (as witnessed recently), 60/40 portfolios would also suffer tremendous losses.

A direct relationship exists between loss contribution to a portfolio from its underlying components, and their risk contribution counterparts. The risk contribution of component i is the share of total risk of the portfolio which is attributable to this component.

I propose a simple way to measure the homogeneity of risk contributions, which is related to the efficiency of the portfolio risk diversification. The risk diversification efficiency measure guarantees that the risk contribution weights are not too widespread. It works with negative risk contributions which are typical with bonds in a traditional portfolio, due to the negative correlations with stocks or alternative assets. The lower the value of the risk diversification measure, the more efficient the risk diversification of the portfolio.

The dramatic downturn in 2008 severely shook the confidence of investors in the ability of traditional risk management practices to mitigate their downside exposure. Traditional portfolio optimization with asset weights constraints might not generate truly risk-diversified portfolio. The resulting optimal portfolios tend to be overly concentrated in a very limited subset of the full assets or securities spectrum. For example, traditional 60/40 (i.e., S&P 500 and Lehman Aggregate) or so-called balanced portfolios do not offer investors true diversification because the 60% stock allocation (S&P 500) actually accounts for almost 95% of the portfolio risk. In a sense, 60/40 portfolios put almost all the “eggs” in one basket. When (not if) the stock market has a severe downturn (as witnessed recently), 60/40 portfolios would also suffer tremendous losses.

A direct relationship exists between loss contribution to a portfolio from its underlying components, and their risk contribution counterparts. The risk contribution of component i is the share of total risk of the portfolio which is attributable to this component.

I propose a simple way to measure the homogeneity of risk contributions, which is related to the efficiency of the portfolio risk diversification. The risk diversification efficiency measure guarantees that the risk contribution weights are not too widespread. It works with negative risk contributions which are typical with bonds in a traditional portfolio, due to the negative correlations with stocks or alternative assets. The lower the value of the risk diversification measure, the more efficient the risk diversification of the portfolio.

An Innovative ETFs Solution based on Core- Satellite Framework

Core/Satellite delivers the best of both worlds. Passive core investments gives the investor a low cost , tax effective and diversified portfolio, while active satellite exposures gives potential for enhanced returns. The core component of the portfolio is attuned to the investor’s long-term strategic aims, comprising assets that reflect the investor’s appetite for risk. The risk and return are optimally balanced in line with the investment goals of the

Friday 2 October 2009

Taming the Beast for the Beauty - The "FIT" Framework for Currency Strategy

As you may notice, the FX market has become extremely volatile recently, thanks for the obscure economic outlook and the massive money printing process of major central banker all around the world.

Yes, high volatility means more investment opportunities,only if one can find the "holy grail" for the market. Unlike those traditional trading models built on price momentum (technical models) or rate differentials (the carry trade model), I have recently developed a new framework for currency trading which employs a nubmer of factors including Fundamental factor, Irrational factor, and Technical factor. The FIT model (the abbreviation for the first letter of all the three factor categories) is built as a fusion of fundamental analysis and financial engineering, which may benefit from pronounced up or down trends in the global FX markets. The currencies included in the strategy are Euros, British Pounds, Canadian Dollars, Swiss Francs, Australian Dollars, and Japanese Yen.

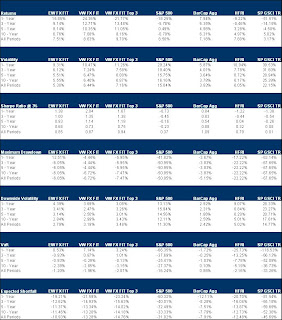

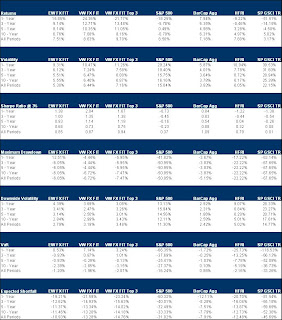

The following tables show the historical backtesting results for the strategy. Over the last 20 year, only 2 years realized small negative returns (-0.36% for 1994 and -0.19% for 2007)…

Yes, high volatility means more investment opportunities,only if one can find the "holy grail" for the market. Unlike those traditional trading models built on price momentum (technical models) or rate differentials (the carry trade model), I have recently developed a new framework for currency trading which employs a nubmer of factors including Fundamental factor, Irrational factor, and Technical factor. The FIT model (the abbreviation for the first letter of all the three factor categories) is built as a fusion of fundamental analysis and financial engineering, which may benefit from pronounced up or down trends in the global FX markets. The currencies included in the strategy are Euros, British Pounds, Canadian Dollars, Swiss Francs, Australian Dollars, and Japanese Yen.

The following tables show the historical backtesting results for the strategy. Over the last 20 year, only 2 years realized small negative returns (-0.36% for 1994 and -0.19% for 2007)…

Subscribe to:

Posts (Atom)